Original equipment manufacturer (OEM) Xiaomi India plans to ship 70 crore devices over the next 10 years, including smartphones, televisions, tablets and connecting devices.

Xiaomi India President Muralikrishnan B said the company plans to further expand manufacturing partnerships in India for enhanced local value addition. “As of 2023, approximately 35% of the non-semiconductor BOM (Bill of Materials) of the phone will be sourced locally. With our strategy to broaden and deepen the company's localization ecosystem, we expect this number to rise to 55% of a smartphone's non-semiconductor board in the next two years,” Muralikrishnan said.

Noting that the smartphone maker plans to source locally in the next two years, Xiaomi India's top executive said the company is aiming to increase the "net domestic value addition" of smartphones to 22% by 2025. By the end of 2023, the metric was around 18%.

He said that Xiaomi has sold 25 crore devices in the country so far in ten years. On the OEM's future sales strategy, Muralikrishnan said the company will focus on four key areas, namely competitive pricing, marketing across social media, omnichannel distribution strategy and increased investment in after-sales service.

The Xiaomi India president believes that the premiumization "trend" has impacted the entry-level and mid-range smartphone segments. Considering that the average selling price of smartphones has increased to Rs 20,800 in 2024 (so far) from Rs 8,800 in 2014, Muralikrishnan added that the mid segment (INR 10,000 to INR 15,000) will continue to lead the share.

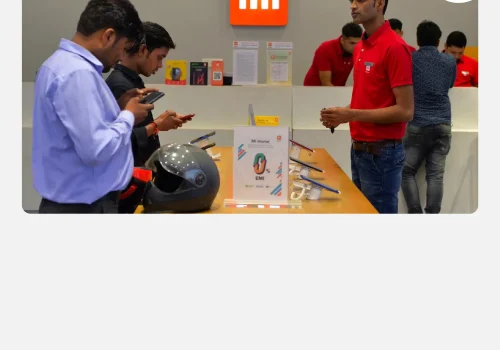

Emphasizing that "single product brands no longer exist," he said consumers are increasingly leaning toward an "ecosystem experience" of connected devices that includes phones, smartwatches, and tablets.

Xiaomi's pivot to India comes at a time when the Indian government is pulling out all the stops to roll out the red carpet for global electronics companies under its "Make in India" initiative. Be it subsidies, or production-linked-incentives (PLIs), the central government has taken all means to attract these OEMs.

On the other hand, more and more manufacturers are looking to turn to India as tensions rise between Beijing and Washington, DC. While Apple's vendor Foxconn has been increasing its presence in India over the past few years, Xiaomi has also ramped up production in the country in partnership with domestic contract manufacturer Dixon Technologies.

In February this year, Xiaomi had internally told Indian authorities that smartphone component suppliers were wary of starting operations in the country. At the time, local officials were asked to consider offering production incentives and reducing import tariffs for certain smartphone components.

Meanwhile, Xiaomi slipped to second place in terms of smartphone shipments in the first quarter (Q1) of 2024 with a 19% market share, according to Counterpoint data.